the inflation effect toward industry in developing country, namely Indonesia

Updated Today

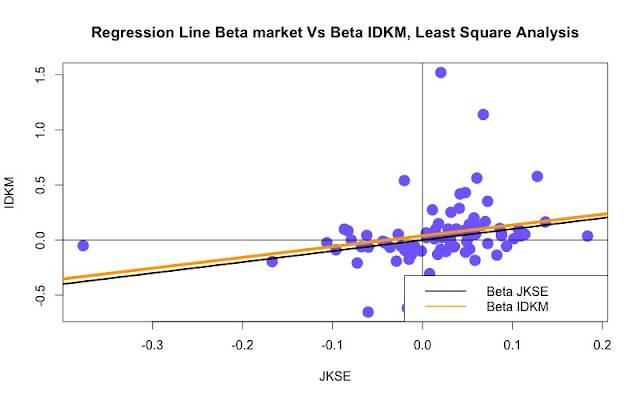

The basic of analysis will be based on the concept of Capital Asset Pricing Model or more familiar being known as the CAPM concept. This model put the movement of agrregate index as the beta of the market. Here we try to replace the beta market with the inflation and see how is it look like toward index of industry in Indonesia.

One of the more develop and focus here is, we also attach the date

of the announcement from the rise of domestic oil price. Many economist

belief that the rise of oil price trigger the inflation to be wilder.

Therefore we will see how this judgment occur in the real laboratory.

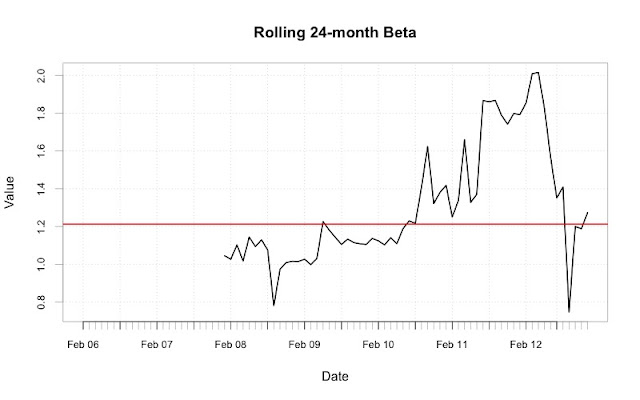

From the graph above we could see that inflation really affect the

index mostly on crisis 2008. Before the occasion index of the industry

and inflation did not really affect each other.

From the rolling adj R square, its obviously seen that in Feb 2008

and Feb 2012, is the moment where most of the index was affected by the

inflation. These analysis become interesting since at that time there

was huge world crisis in the world. So somehow Indonesia also give some

respond toward it.

For further and deep analysis of this phenomenon, you can contact me directly toward email in dimasmukhlas@yahoo.com!

cheers!