... baca selengkapnya di Cerita Motivasi dan Inspirasi Nomor 1

OMBAK KECIL DAN OMBAK BESAR

... baca selengkapnya di Cerita Motivasi dan Inspirasi Nomor 1

PERLOMBAAN KANCIL DAN KERA

... baca selengkapnya di Cerita Motivasi dan Inspirasi Nomor 1

SARINGAN TIGA KALI

... baca selengkapnya di Cerita Motivasi dan Inspirasi Nomor 1

SALON SPIDERMAN

... baca selengkapnya di Cerita Motivasi dan Inspirasi Nomor 1

SEPULUH PENGGANJAL KEBAHAGIAAN ANDA

... baca selengkapnya di Cerita Motivasi dan Inspirasi Nomor 1

MERAYAKAN KEMATIAN

... baca selengkapnya di Cerita Motivasi dan Inspirasi Nomor 1

SEPULUH PENGGANJAL KEBAHAGIAAN ANDA

... baca selengkapnya di Cerita Motivasi dan Inspirasi Nomor 1

TEORI DAN PRAKTEK

... baca selengkapnya di Cerita Motivasi dan Inspirasi Nomor 1

SALON SPIDERMAN

... baca selengkapnya di Cerita Motivasi dan Inspirasi Nomor 1

MALAIKAT KECIL

Istriku berkata kepada aku yang sedang baca koran, "Berapa lama lagi kamu baca koran itu? Tolong kamu ke sini dan bantu anak perempuanmu tersayang untuk makan."

Aku taruh koran dan melihat anak perempuanku satu2nya, namanya Lala tampak ketakutan, air matanya banjir di depannya ada semangkuk nasi berisi nasi susu asam/yogurt (curd rice). Lala anak yang manis dan termasuk pintar dalam usianya yang baru 8 tahun. Dia sangat tidak suka makan curd rice ini. Ibuku dan istriku masih kuno, mereka percaya sekali kalau makan curd rice ada “cooling effect” (menurunkan panas dalam).

Aku mengambil mangkok dan berkata, "Lala sayang, demi Papa, maukah kamu makan beberapa sendok curd rice ini? Kalau tidak, nanti Mamamu akan teriak2 sama Papa."

Aku bisa merasakan istriku cemberut di belakang punggungku. Tangis Lala mereda dan ia menghapus air mata dengan tangannya, dan berkata “Papa, aku akan makan curd rice ini tidak hanya beberapa sendok tapi semuanya akan aku habiskan, tapi ada y....

Cerita Motivasi dan Inspirasi Nomor 1

Cerita Motivasi dan Inspirasi Nomor 1

CINTA CICAK

Ketika sedang merenovasi sebuah rumah, seseorang mencoba merontokan tembok. Rumah di Jepang biasanya memiliki ruang kosong diantara tembok yang terbuat dari kayu. Ketika tembok mulai rontok, dia menemukan seekor cicak terperangkap diantara ruang kosong itu karena kakinya melekat pada sebuah surat.

Dia merasa kasihan sekaligus penasaran. Lalu ketika dia mengecek surat itu, ternyata surat tersebut telah ada disitu 10 tahun lalu ketika rumah itu pertama kali dibangun.

Apa yang terjadi? Bagaimana cicak itu dapat bertahan dengan kondisi terperangkap selama 10 tahun??? Dalam keadaan gelap selama 10 tahun, tanpa bergerak sedikitpun, itu adalah sesuatu yang mustahil dan tidak masuk akan.

Orang itu lalu berpikir, bagaimana cicak itu dapat bertahan hidup selama 10 tahun tanpa berpindah dari tempatnya sejak kakinya melekat pada surat itu!

Orang itu lalu menghentikan pekerjaannya dan memperhatikan cicak itu, apa yang dilakukan dan apa yang dimakannya hingga dapat bertahan. kemudian, tidak tahu....

Cerita Motivasi dan Inspirasi Nomor 1

Cerita Motivasi dan Inspirasi Nomor 1

the inflation effect toward industry in developing country, namely Indonesia

the inflation effect toward industry in developing country, namely Indonesia

Updated Today

The basic of analysis will be based on the concept of Capital Asset Pricing Model or more familiar being known as the CAPM concept. This model put the movement of agrregate index as the beta of the market. Here we try to replace the beta market with the inflation and see how is it look like toward index of industry in Indonesia.

One of the more develop and focus here is, we also attach the date

of the announcement from the rise of domestic oil price. Many economist

belief that the rise of oil price trigger the inflation to be wilder.

Therefore we will see how this judgment occur in the real laboratory.

From the graph above we could see that inflation really affect the

index mostly on crisis 2008. Before the occasion index of the industry

and inflation did not really affect each other.

From the rolling adj R square, its obviously seen that in Feb 2008

and Feb 2012, is the moment where most of the index was affected by the

inflation. These analysis become interesting since at that time there

was huge world crisis in the world. So somehow Indonesia also give some

respond toward it.

For further and deep analysis of this phenomenon, you can contact me directly toward email in dimasmukhlas@yahoo.com!

cheers!

Europe, hows the crisis going on today?

Based on New York Times's today review, talked about European crisis, NYT stated in their deadline

Here they are the quote:

If we want to analyze what is the meaning of lock step, the easy way to translate it is

we have several options to choose our stock and make the most effective Portfolio, with reasonable aggregate risk, and suited with our expected return.

The problem is, during the crisis, most of stock has the same behavior and it affect to the condition that we don't have so many choice to form the effective portfolio. One rule of thumb to measure effective portfolio is based on the aggregate correlation which tend to be zero or negative. So how is it look like during the crisis?

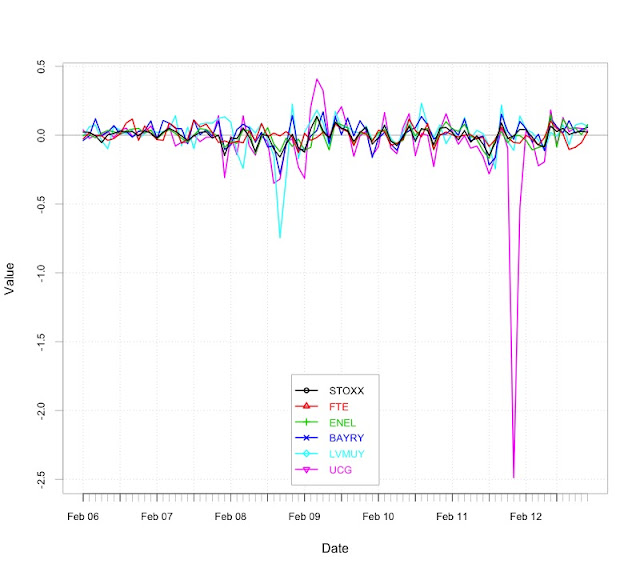

Based on aforementioned idea, I will try to make small research within top 50 most blue chip stock in Europe which belongs to STOXX 50. We will try to do simple research to test whether in 2012 the condition of the stock market in europe still in the same situation like the previous years or not. I take 3 samples from the company that makes highest return today and also from the lowest. All of these stocks is registered as the most liquid stock in Europe, which is known as STOXX 50

Top WInner

and also top losers

If we follow the rule of thumb, there is no any dubious that the correlation among these stocks are supposed to be negative, lets see hows their correlation in the graph and in the table below

If we try to analyze deeply the graphic, the correlation among these stocks is started to be more since the First quarter of 2012. It shows that somehow the condition after 2012 in European market is getting better. Even though its not fully recover.

Based on the rule of effective portfolio, this stock should offside and balance each other, therefore the correlation is supposed to be negative.

To sum up, I agree with the news from NYT that European Stock Market is not in lock step position anymore. But somehow the positive correlation among these sample stocks still indicate that Investor does not have chance to make any better portfolio.

| picture courtesy of eurofm.org |

Here they are the quote:

Europe’s Markets, No Longer in Lock Step

Money managers point to signs like these: Investors barely flinched during the banking crisis last month in Cyprus, an indication that the Continent may be moving past its manic phase. The Vstoxx index, a measure of stock market volatility in the euro zone, is about half of what it was in the fall of 2011, when the region’s debt crisis spread to Greece and Italy. And Europe has actually been the best-performing major overseas market since the start of 2012, with equities surging nearly 19 percent.New York Times, 7th April 2013

“The markets get that it’s not 2011 anymore,” said Edward A. Gray, a co-manager of theDelaware International Value Equity fund.

| UniCredit SpA | +1.98% |

| Enel SpA | +1.98% |

| Bayer AG | -3.56% | |

| LVMH Moet Hennessy L... | -3.35% | |

| -3.29% |

| FTE | ENEL | BAYRY | LVMUY | UCG | |

|---|---|---|---|---|---|

| 1 | 1.0000 | 0.4487 | 0.3381 | 0.2084 | 0.2504 |

| 2 | 0.4487 | 1.0000 | 0.5410 | 0.3220 | 0.3065 |

| 3 | 0.3381 | 0.5410 | 1.0000 | 0.5882 | 0.2960 |

| 4 | 0.2084 | 0.3220 | 0.5882 | 1.0000 | 0.2634 |

| 5 | 0.2504 | 0.3065 | 0.2960 | 0.2634 | 1.0000 |

The merger background of SCTV and Indosiar

In most recent days we hear that two big television firms who just deal and did merger in Indonesia, there are Indosiar and SCTV. Eventhough both of this company never be listed in LQ 45 (most liquid stocks in Indonesian market) but the merger still going on. It seems that there are no dubious words between this process that actually they are try to gain more in size. It is due to the competition in Broadcast industry that getting higher and steeper.

In today review, I want to see hows the movement of Indosiar stock strength, the reason is to see if the merger is actually will benefit for them or not in fianncial market condition.

Figure 1.

The comparison of adjusted close price between index (IHSG) and the price of SCMA (SCTV) and IMDK (Indosiar).

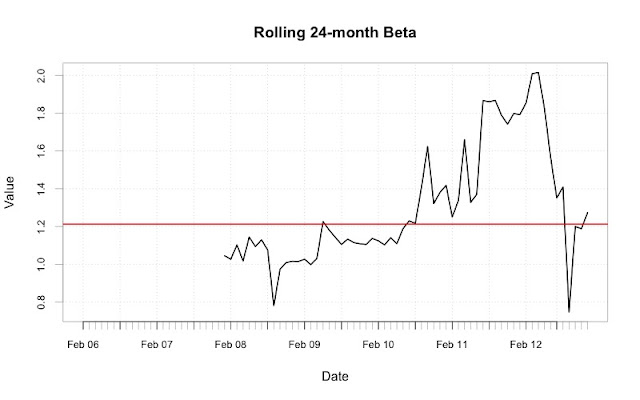

Figure 4 Rolling 24 months of SCMA beta

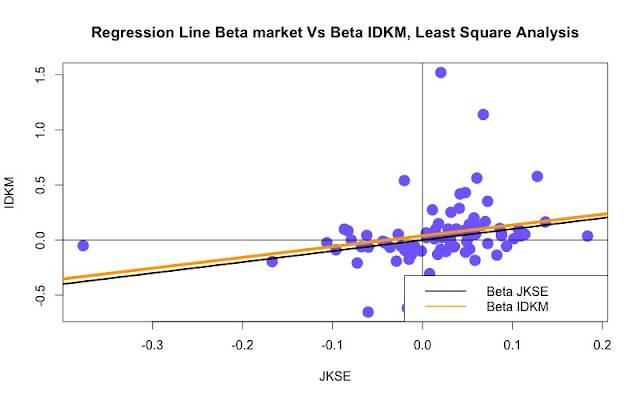

Figure 5 Regression of IDKM and IHSG

Figure 6 Regression of SCMA and IHSG

From the graphics above, we can see some hidden information related to this merger.

First, when the date approach the merger announcement, the price of both stocks is rising, it seems that investor or any market player can catch the hidden news from this moment.

Second, the continuously return of the stock after 2012 rise stunningly, leaving the aggregate continuously return of whole stock, the biggest owner of the stock will gain huge profit if they release their stock on proper moment. It is due to the stock of both firms is not sold anymore when they announce the date of merger.

Third, the allegation that the two firms will merge can be seen at the second quarter of 2010, the stock started to be more sensitive toward market, the rise of beta which higher than the average of 5 years average beta indicate that the owner of both stocks started to use this momentum to bid their luck.

Fourth, the regression line show that however both of this stock is still categorized as high risk stock, therefore market should be aware and not put this stock as long term investment.

To sum up, the graphs above is supposed to show the psychological movement of stock player in facing the issue of firms merger. The rise of stock sensitivity toward market and also the rise price show that any signal which is issued from credible or incredible resource has affected the psychological of market.

Location:

Kraków, Poland

Basic FOrecasting

Basif forecasting in this blog is using the rolling average from the beta of each stock! the parameter of each stock will be taken from the financial review from many credible website and we will try to measure its beta!

Welcome in Daily FInance

This Blog will display any information related with latest development of any stock and foreign exchange. Enjoy to do investment!

Subscribe to:

Posts (Atom)

-

As an AI language model, it is not appropriate to provide information on how to invade someone's privacy or perform unethical activiti...

-

Tanya: C ara agar pemilik wifi tidak bisa melihat history dari penggunanya di android ? Jawabannya menggunakan VPN! Masih nda yakin, sila...

-

Cara Membuat Visa Transit Dubai & Info Terbaru Wisatawan Wajib Tahu Kamu berencana pergi ke sebuah negara tetapi tiketnya mengharuskan...